Is Salesforce a buy?

- Luke Donay

- Feb 8, 2021

- 3 min read

It’s time to talk about one of the most well-known cloud names within the market. Here is the breakdown on $CRM, otherwise known as Salesforce.

Current Price: $237.84

52/Wk High: $284.50

52/Wk Low: $115.29

Market Cap: $218.3 billion

Read below for the breakdown!

Salesforce ($CRM) is a major provider of software for enterprise customers. The majority of the Salesforce offerings use cloud technology and the company operates in a vast array of technology fields.

In recent news, Salesforce announced the acquisition of Slack ($WORK) for a whopping $27.7 billion. The deal consists of both cash and stock and will create a more head-on competition dynamic between Salesforce and Microsoft.

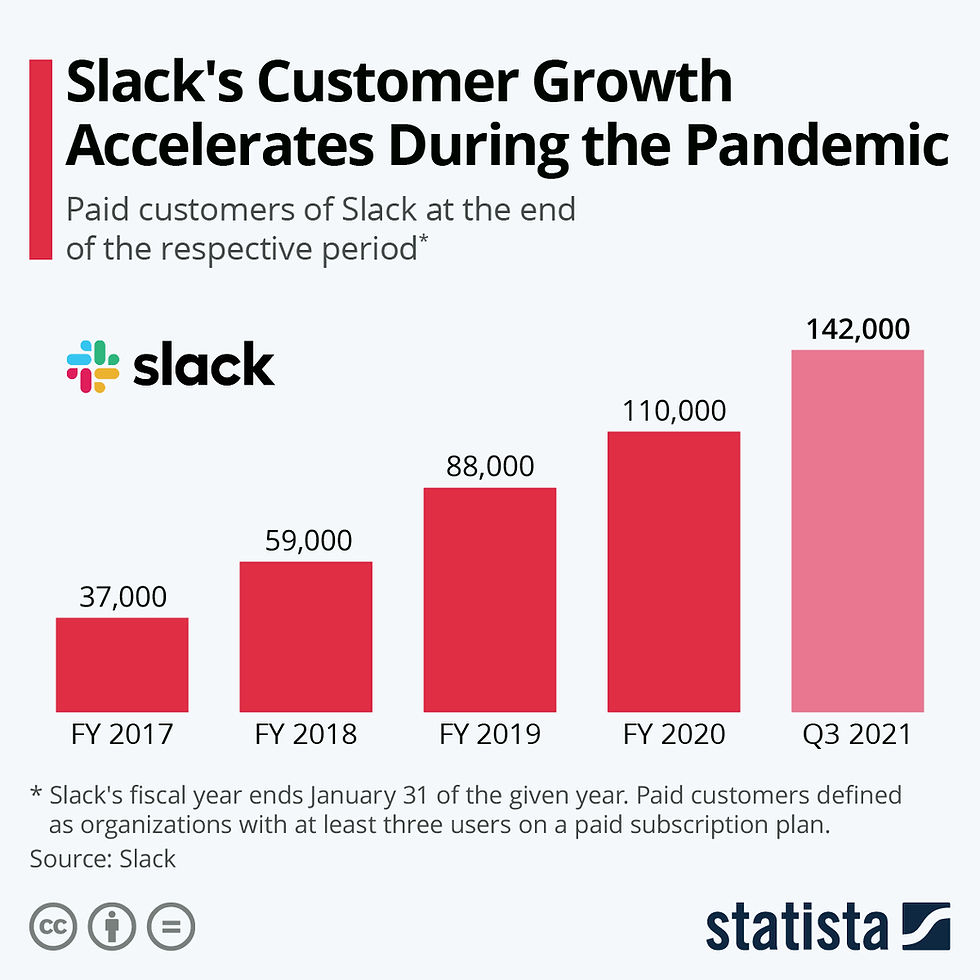

Digging into the acquisition Salesforce looks to make Slack the peak of the iceberg when it comes to their Customer 360 effort. Not only that but Slack ended Q3 with 142,000 paid customers (Up 35%) leaving investors to wonder what Slack could really turn into with Salesforce behind them.

Breaking down the stock price according to TREFIS (@trefis) data 56.68% of the price is based on Salesforce’s Cloud-Based CRM Software segment.

Furthermore, 38.34% of the stock price is base on the company’s Cloud Software segment, 0.7% is based on their Consulting & Services segment, and 4.28% is based on cash.

Digging into the numbers, Salesforce impressed once again with a Q3 2021 beat, delivering an EPS of $1.74, much better than the analyst’s consensus estimate of $0.75. On a year over year basis, EPS improved by 132%.

Not only that but Salesforce reported revenue growth of 20% year over year, bringing Q3 revenue to a whopping $5.42 billion, continuing their pattern of consistent revenue growth.

The company also reported the current remaining performance obligations (future revenues under contract) totaled $15.3 billion, representing a 20% increase.

Breaking the Salesforce’s revenues down the subscription and support revenues totaled $5.09 billion (up 20% YOY) and the professional services and other revenues totaled $0.33 billion (up 22% YOY).

Salesforce went on to report that the third quarter non-GAAP operating margin landed at 19.8% and GAAP operating margin landed at 4.1%.

Salesforce management also produced solid guidance for both Q4 and the years ahead. Management expects revenues to total $5.665 billion to $5.675 billion in the fourth quarter, representing a roughly 17% year over year increase.

When it comes to FY 2021, management raised revenue guidance to a range of $21.10 billion to $21.11 billion, representing a roughly 23% increase in revenues year over year.

Salesforce also produced Q1 2022 revenue guidance, noting that Q1 2022 revenues are expected to land within a range of $5.680 billion to $5.715 billion. For FY 2022 revenue guidance as a whole, revenues are expected to land within a range of $25.45 billion to $25.55 billion.

Management was upbeat and positive for the future.

“We’re rapidly moving to an all-digital world, where work happens wherever people are.” CEO Mark Benioff said.

Taking a look at the balance sheet the numbers are quite solid.

Total Debt: $2.672 billion

Total Liabilities: $18.826 billion

Total Assets: $59.136 billion

Cash & Short Term Inv: $9.492 billion

While the numbers are stellar the valuation has gotten a bit extended.

Price to Earnings: 143.45x

Price to Sales: 10.81x

Price to Book: 5.42x

Price to Cash Flow: 31.22x

Management has also been quite effective.

Return on Equity: 4.25%

Return on Assets: 2.87%

Return on Invested Capital: 3.62%

Given the numbers, the analysts are bullish with a mean price target of $275.44/share, representing a 15.69% gain.

It is also important to note that the high price target is $320.00/share, representing a 34.40% upside, while the low price target is $217.00/share, representing a -8.86% downside.

The big money is quite involved as well with 80.75% of Salesforce being owned by institutions. Top holders include Fidelity Management & Research, The Vanguard Group, and T. Rowe Price Associates.

On a technical basis, $CRM could be flashing opportunity as well! According to the six-month charts, the MACD has recently crossed back to the upside within a range of 3.32 down to 1.17.

The six-month charts are also indicating an RSI of 66.83 and CCI of 147.88, both of which are on the high end but not terrible given how far the stock has sold off its highs since the announcement of the Slack acquisition.

In short, Salesforce is an excellent long term investment given the digital workplace shift, consistent double-digit growth, and an ever-improving product offering that will be strengthened by Slack.

EAT - SLEEP - PROFIT

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Comments